Washington State Governor Jay Inslee signed Engrossed Senate Bill 5901 on March 31, 2022, authorizing a new sales and use tax-deferral program effective July 1, 2022.

The bill, targeting counties with a population of fewer than 650,000, permits businesses engaging in manufacturing or R&D to postpone payment of sales and use taxes due in connection to investment projects in qualifying counties. Additionally, businesses may be entitled to full or partial abatement of the sale and use taxes deferred under the program if certain requirements are met.

Overview of Sales Tax Deferral Program

Effective July 1, 2022, Washington businesses that engage in manufacturing and R&D activities may apply for a deferral of sales and use taxes.

The new sales and use tax-deferral regime allows businesses to postpone payment of sales and use taxes related to certain eligible investment projects.

Eligible Investment Projects

Eligible investment projects include the following.

Qualified Buildings

New structures, or the expansion or renovation of existing structures to increase floor space or production capacity for manufacturing or R&D activities, could qualify.

Plant offices and warehouses could also qualify if such facilities are an essential or integral component of a factory, mill, plant, or laboratory.

Qualified Machinery and Equipment

Investment in new industrial and research fixtures, equipment, and support facilities that are an integral and necessary part of a manufacturing or R&D operation could qualify.

Qualifying machinery and equipment include:

- Computers

- Software

- Data processing equipment

- Laboratory equipment

- Manufacturing components, such as belts, pulleys, and moving parts

- Molds, tools, and dies

- Operating structures

- Equipment used to control machinery

The eligible investment projects must be placed into service in a county that has a population of fewer than 650,000 at the time of application.

Using the 2020 US Census as a guide, investments in 36 of Washington’s 39 total counties could qualify for this sales tax deferral program.

Application Process

An application for the sales and use tax-deferral program must be made before initiation of the construction or purchase of machinery and equipment for an eligible investment project.

An applicant is generally expected to provide data points such as:

- Information regarding the location of the investment project

- The applicant’s average employment in the state for the prior year

- Estimated or actual new employment related to the project

- Estimated or actual wages of employees related to the project

- Estimated or actual costs

- Time schedules for completion and operation

- Other information as required by the Washington Department of Revenue (DOR)

A business can acquire multiple certificates if individual applications are made for separate investment projects within a qualifying county.

The Washington DOR will review deferral applications through June 30, 2032.

Deferral and Compliance Responsibilities

If the Washington DOR approves an application for deferral, a sales and use tax-deferral certificate will be issued to the applicant.

The business must begin meaningful construction on the eligible investment project within two years of acceptance, at which time the business may issue the deferral certificate to vendors who will be relieved of sales and use tax collection responsibilities. A single deferral certificate is valid for up to five calendar years from the date of issuance.

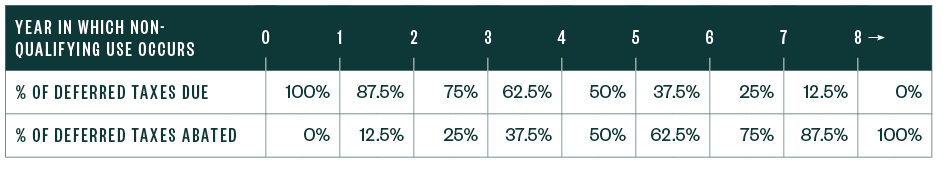

The amount of state and local sales and use taxes eligible for deferral through a certificate is limited to $400,000 per person. Provided the recipient continues to use the investment project in a qualifying manufacturing or R&D activity in the eight years after receiving a deferral certificate, the sales and use tax deferred will be entirely abated. If an investment project is used for a non-qualifying activity, sales and use tax will be proportionally abated according to the following schedule:

Upon receiving a deferral certificate, the recipient must file a complete annual tax performance report with the Washington DOR during the allowed eight-year period where the sales and use tax deferral occurs. The report must contain wage, employment, and tax savings information relating to the investment project involved.

We’re Here to Help

For more information on how this program could affect your state and local taxes contact your Moss Adams professional. You can also find more insights at our State & Local Tax Services.

Special thanks to Alex Pettibone, state and local tax senior, for his contributions to this article.